In line with the evolving trend in CFD and forex trading, instant funding is now a wish for most traders aiming to expand their strategies at a fast pace. In order to be in a position to meet the strict requirements usually associated with access to instant funding—i.e., low drawdowns together with assured profitability—traders have to employ tools that are more accurate and timely. One of the most powerful tools is multi-timeframe analysis, and in the hands of MetaTrader 5 (MT5), it is an extremely powerful edge. MT5 gives traders the ability and freedom they need to display multiple timeframes simultaneously, which helps them make better decisions and perform better under pressure.

What is MT5 Multi-Timeframe Analysis

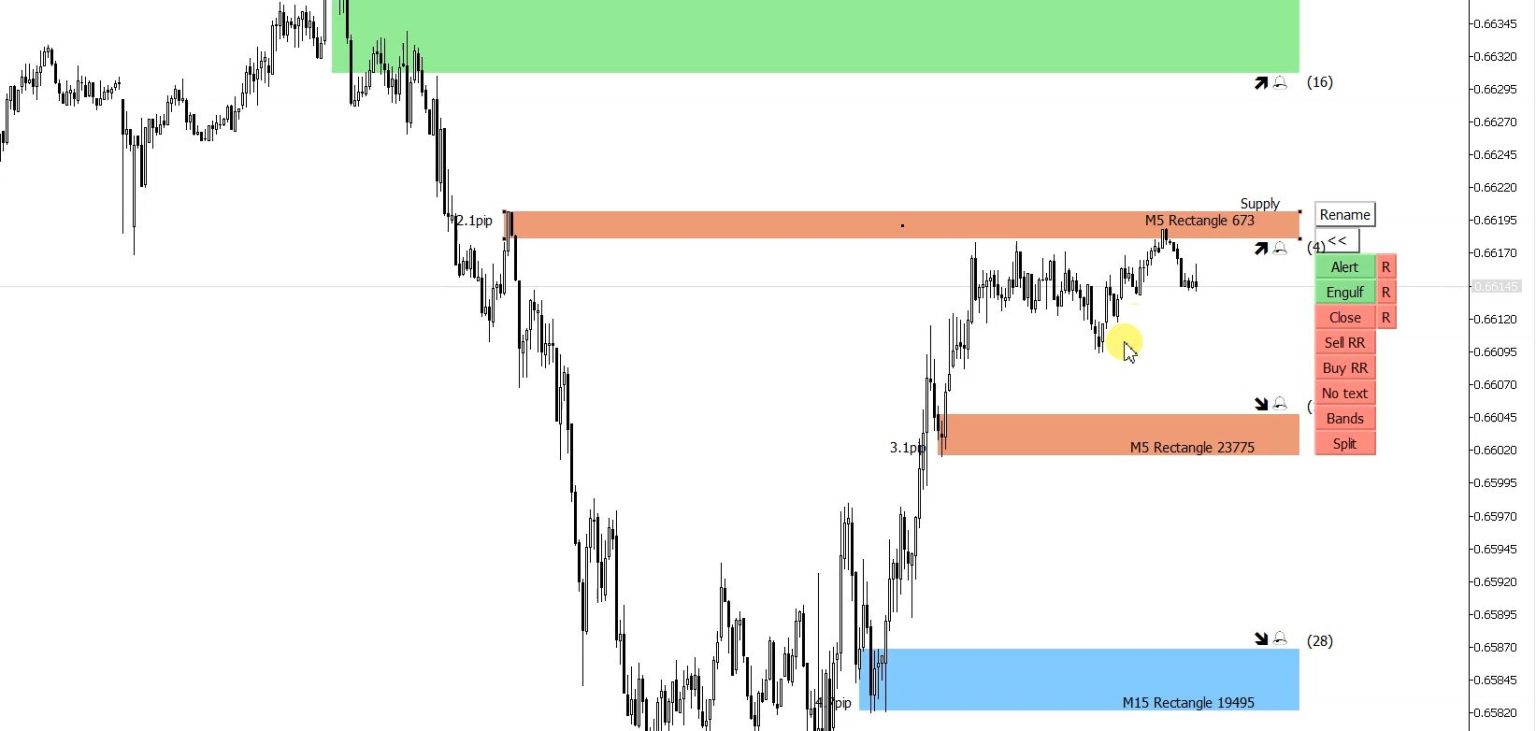

Multi-timeframe analysis, or MTFA, refers to the analysis of a single financial instrument on multiple chart timeframes in an effort to have a more general understanding of the way that things are structured in the market. A trader may, for example, view the daily chart to determine the overall trend, the one-hour chart to see a setup, and the 15-minute chart to enter into a trade. In MT5, all this is automatically carried out since it can see several charts at once, attach indicators to different timeframes, and save chart templates for quick use. With MTFA, the false signals are reduced to a minimum and the entries are harmonized with the overall trend of the market—a very important parameter in the quest for instant funding success.

Why MT5 is Ideal for Multi-Timeframe Trading

MT5 is the perfect platform to use for multi-timeframe trading due to its very sophisticated charting functionality combined with its user-friendly interface. It offers every kind of timeframe from one-minute through month, and also allows for several windows of the same instrument to be open. It makes it very simple to monitor price action and indicator performance from one timeframe to another without having to keep switching views back and forth. The users also get to customize their indicators and save template settings, providing a better repetitive analysis. MT5 also provides support for Expert Advisors (EAs) and automated trading systems, which can be coded to support multi-timeframe thinking. All of these make MT5 a top favorite with traders who need accuracy, especially when working towards instant funding levels.

How Multi-Timeframe Analysis is Useful with Instant Funding

Being funded immediately tends to follow demonstrating the capacity to trade with good discipline, risk management, and a decent edge. Multi-timeframe analysis enables a trader to make more informed choices and, in your situation, to think on higher timeframes like on the 4-hour or even the daily chart that would reflect the overall trend or overall directional bias. Next, using a shorter time frame like the 15-minute or the 5-minute chart, you can pick an entry that is well-timed and in line with the overall trend. This reduces counter-trend trades’ chances of happening and increases the chances of successful trades—both necessary when every trade counts in a funding scenario. MTFA also improves risk management by accurately establishing support, resistance, and stop-loss levels according to structure on different time frames.

Better Trend Identification

The most common mistake made by traders may be to trade against the main trend on the major timeframe, which invariably leads to poor entries and unnecessary losses. MT5’s multi-timeframe facility allows you to start with a higher timeframe such as the daily or 4-hour chart to determine the underlying market trend. When you validate your signs for the trend direction, all your trades on the lower chart are made with stronger belief and fewer excuses. Trend trading according to the signs on the higher chart significantly improves your chances for success, especially if you’re working to fill out the draconian rules and goals of instant funding deals.

Precision Entry Points

After a trader has identified the primary trend on the larger scale, the next step is to zoom in to a smaller scale with the hopes of finding the optimal entry point. For example, after you’ve confirmed an uptrend on the 4-hour chart, you might then look at the 15-minute chart with the hopes of waiting for a bull price pattern or indicator crossover before entering. This is an entry point where you can enter with the minimum possible stop-losses and spectacular risk-reward ratios. MT5 makes this buttery-smooth and intuitive enough to watch a couple of accounts simultaneously at a time in the spirit of receiving actual-time confirmation of a signal. In the era of instant capital, it can be extremely useful in the prevention of emotional trades as well as overall consistency. Multiple-timeframe analysis contributes towards your ability to place logical stop-losses and take-profits on important levels noted on higher and lower charts. A support point on the 1-hour chart, for example, may be even more robust when confirmed on the 4-hour or even the daily chart. MT5 allows you to chart these levels between timeframes, giving you a solid basis on which to manage risk-to-reward. By not trading when it’s foggy and only trading where there are several overlapping timeframes, you reduce drawdowns and your chances of blowing up on performance tests.

Confirmation and Confluence

Confluence is a powerful trading principle, and MT5 offers a simple method of identifying confluence by utilizing various timeframes that provide signals. Where various time frames overlap, as in a bullish trend on the 4-hourly chart, a pullback on the 1-hour chart, and a bullish reversal pattern on the 15-minute chart, it is a setup of higher probability. MT5’s adaptive interface makes it possible for traders to overlay indicators like RSI, MACD, or Moving Averages on all charts so that they can compare like-for-like signals. This kind of confirmation reduces speculation and raises confidence in trades, a requirement when trying to pass an instant funding requirement that can limit the number of trades or permitted per-trade risk.

Sample Strategy Using MT5 Multi-Timeframe Analysis

We will take a sample trading strategy using MT5 so we can get instant funding. Let’s assume you are reviewing EUR/USD. On the 1-hour chart, you notice that the pair is strongly trending with clear higher highs and higher lows. On the 1-hour chart, you notice there’s a pullback to a key support point, maybe a 50-period moving average. Skipping over to the 15-minute chart, you notice there’s a bullish engulfing candle followed by a MACD crossover. Through this verification over multiple time frames, you go long with a stop-loss placed below the support level and a 1:2 risk-reward target. This disciplined technique succeeds, replicates, and is ideal for meeting the requirements of instant access to capital.

MT5 Download: Getting Started with Multi-Timeframe Analysis

The start in the application of multi-timeframe analysis in MT5 is downloading the MetaTrader 5 software from a reputable source. When set up, have two or more charts for one trading instrument open and assign a different timeframe to each. Apply your preferred indicators—i.e., RSI, Moving Average, or Fibonacci retracement—and save them as templates for easy access. MT5 is designed to be fast so that you can see trends, entries, and exits simultaneously on multiple timeframes. Regardless of whether you trade manually or use EAs, this configuration gives you a sound analysis platform with which to attain instantaneous funding performance objectives in confidence.

Last Thoughts

If you are serious about becoming instant funding qualified, studying multi-timeframe analysis on MT5 can give you that competitive advantage which you need. This method allows you to be in sync with market trends, enter more precisely, and manage risk more effectively. MT5’s native functionality, flexibility, and analytical horsepower create an ideal platform for profitable application of this technique. By combining technical knowledge with strategic thinking, you can trade disciplined and confident—two traits essential to profitability in any high-risk trading environment. Start incorporating multi-timeframe analysis into your workflow today and take a huge step toward profitable trading.